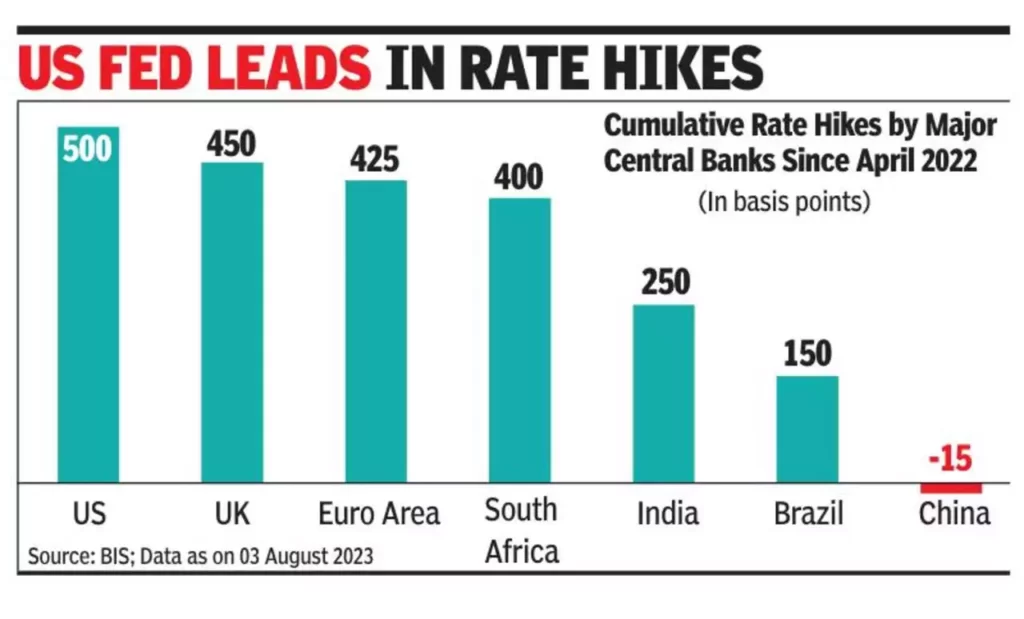

The Reserve Bank of India is expected to take a cautious approach in its monetary policy statement this week, as inflation threatens to surpass the central bank’s target level. The Monetary Policy Committee (MPC) will meet from August 8 to 10 to review the repo rate, which was raised to 6.5% in February 2023. In the two MPC meetings that followed, there was no change in rates. Economists do not predict a rate cut this year, but anticipate a downward trend in rates next year. The MPC meeting coincides with recent interest rate hikes by central banks in the US, Europe, and the UK aimed at curbing inflation.

Given the volatility in the foreign exchange market, the central bank is also unlikely to ease liquidity. The rupee has declined to a two-and-a-half-month low, while the dollar has strengthened against major currencies. Chief economist at the SBI group, Soumya Kanti Ghosh, expects the RBI to pause in the August policy and believes that inflation will taper due to seasonal factors. Another economist from a public sector bank noted that although the RBI has warned of an upcoming spike in inflation, the decision to hike rates is unlikely due to temporary vegetable price increases and the lingering effects of the previous rate hike in February.

Chief economist at Deutsche Bank, Kaushik Das, stated that although it is highly unlikely for the MPC to raise rates in the upcoming policy, it cannot be completely ruled out as the RBI has surprised the market in the past. Deutsche Bank forecasts CPI inflation to reach 6.7% YoY in July, driven by a significant increase in vegetable prices, particularly tomatoes. However, excluding vegetables, CPI inflation is expected to remain around 5.2%. Fund manager at Quantum AMC, Pankaj Pathak, expects the RBI to overlook the recent food inflation and find comfort in the decline in core inflation.